wa car sales tax calculator

The state in which you live. Use tax rates.

Any caravan defined as a trailer including a camper trailer permanently fitted for human habitation in the course of a journey is exempt from the payment of Vehicle Licence.

. Local tax rates in Washington range from 0 to 39 making. Sum of Monthly Payments. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

New car sales tax OR used car sales tax. Look up a tax rate. The tax is collected by the vendor at the.

How much is the car sales tax rate in Washington. 635 for vehicle 50k or less. There is base sales tax by Washington.

As far as all cities towns and locations go the place with the highest sales tax rate is Tontitown and the place with the lowest sales tax rate is Canehill. Sales Tax 2380. On top of that is a 03 percent leasevehicle.

Car tax as listed. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. 775 for vehicle over 50000.

The statewide motor vehicle surtax or 003 has been collected since 2003 applies to all retail sales leases and transfers of motor vehicles and is used to finance transportation improvements. County and local tax jurisdictions levy an additional 05 to 35 in vehicle sales tax depending on where you buy. Search by address zip plus four or use the map to find the rate for a specific location.

Washington has a state sales tax rate of 65 but the state adds another 03 in vehicle salelease tax bringing the total starting tax rate up to 68. The type of license plates requested. The one with the highest sales tax rate is 72770 and the one with the lowest sales tax rate is 72717.

According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State. How are car loans in Washington calculated. Whether or not you have a trade-in.

Counties cities and districts impose their own local taxes. You can always use Sales Tax calculator at the front page where you can modify percentages if. The county the vehicle is registered in.

During the year to deduct sales tax instead of income tax if their total sales tax payments exceed state. Tax and Tags Calculator. Skip to main content.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. How much is sales tax in Auburn in Washington. US Sales Tax Washington Kitsap Sales Tax calculator.

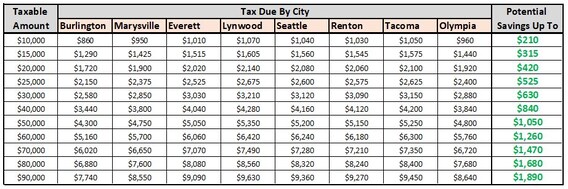

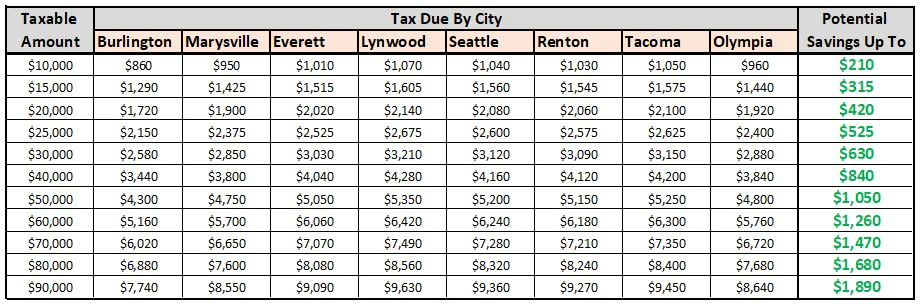

In the case where a vehicle is purchased more than 2000 below the fair market value of the vehicle determined by pricing guides like Kelley Blue Book the state will assess the tax you owe on the average fair market value. The base state sales tax rate in Washington is 65. With an 86 Sales Tax here in Burlington WA and start saving.

Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. If youre looking for incredible savings youll find great deals on amazing cars and phenomenal tax savings when you buy your next vehicle here. Use tax is calculated at the same rate as the sales tax at the purchasers.

Our free online Washington sales tax calculator calculates exact sales tax by state county city or ZIP code. The tax amount is based upon the value of the vehicle at the time of purchase and is the same retail sales tax of 65. Vehicle licence duty calculator 20212022 Driver and Vehicle Services is required by the Duties Act 2008 to collect vehicle licence duty when a vehicle is licensed or its licence is transferred.

The sales tax rate for Auburn was updated for the 2020 tax year this is the current sales tax rate we are using in the Auburn Washington Sales Tax Comparison Calculator for 202223. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. Washington includes the sale price and the doc fee in the taxable amount of an auto loan but does not include the trade-in value.

Start filing your tax return now. Remember that the total amount you pay for a car out the door price not only includes sales tax but also registration and dealership fees. KarMART Volkswagen 1725 Bouslog Road Directions Burlington.

26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Sales Tax 40000 - 5000 068. 425 Motor Vehicle Document Fee.

When you purchase a vehicle or vessel from a private party youre required by law to pay use tax when the vehicle or vessel title is transferred. Curious about car sales tax in Washington. Before-tax price sale tax rate and final or after-tax price.

If this rate has been updated locally please contact us and we. Sales tax in Auburn Washington is currently 10. Use tax is a tax on items used in Washington when sales tax hasnt been paid.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. How much is sales tax in Washington. Try our FREE income tax calculator.

TAX DAY NOW MAY 17th - There are -415 days left until taxes are due. Therefore car buyers get a tax break on trade-in vehicles in Washington. Thus vehicle sales taxes in Washington can range from 73 to 103 based on where the transaction is made.

The most populous zip code in Washington County Arkansas is 72764.

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator Foothills Toyota

Dmv Fees By State Usa Manual Car Registration Calculator

Trade In Sales Tax Savings Calculator Find The Best Car Price

Washington Sales Tax Small Business Guide Truic

Car Sales Tax Savings Car Incentives In Burlington Wa

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Auto Sales Tax Calculator Buy A Vw Near Marysville Wafacebook

Car Tax By State Usa Manual Car Sales Tax Calculator