nj ev tax credit tesla

Teslas super SUV the Model X is unlikely to see any major changes for the 2023 model year. A tax credit of up to 7500 could be used.

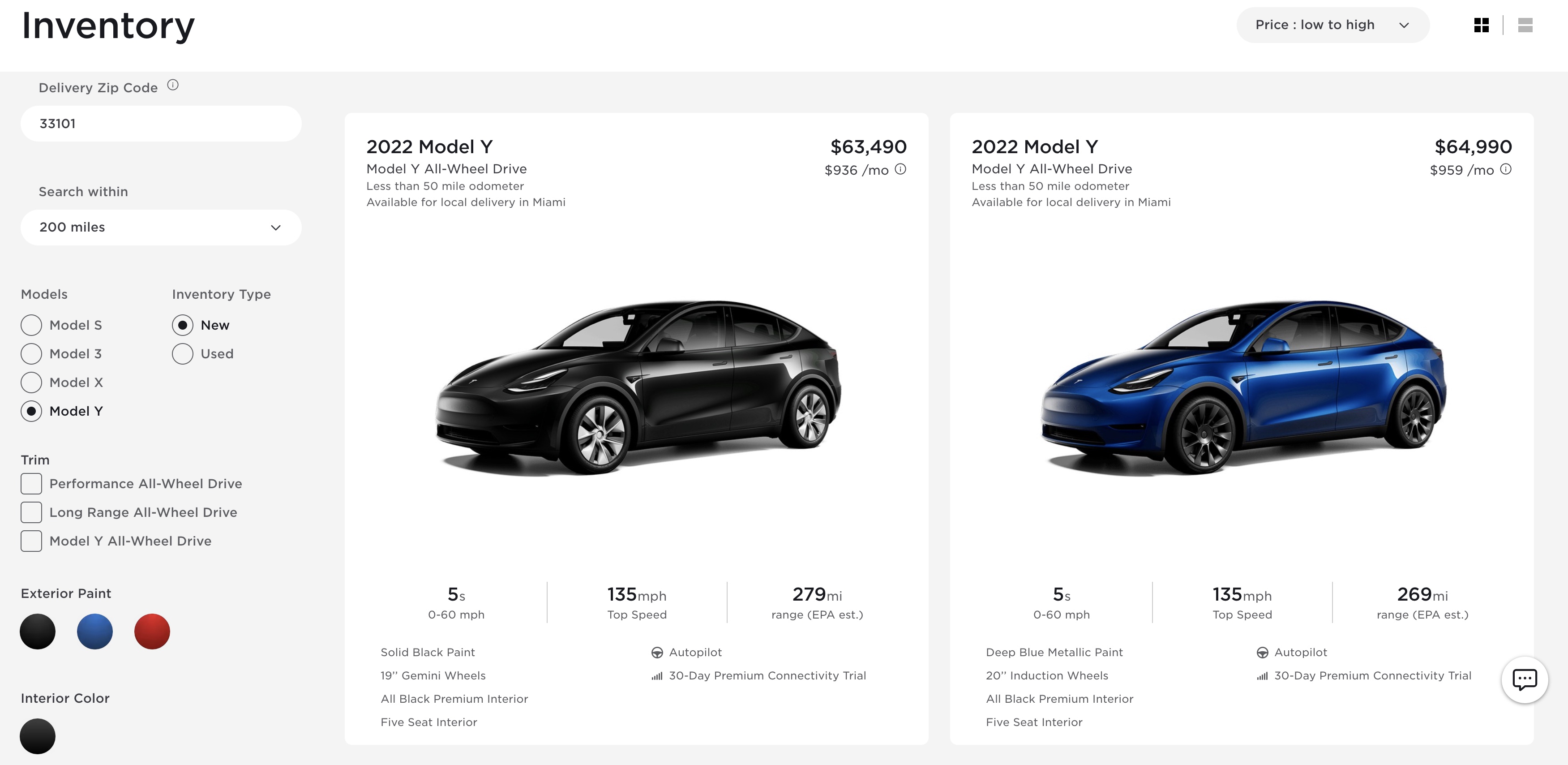

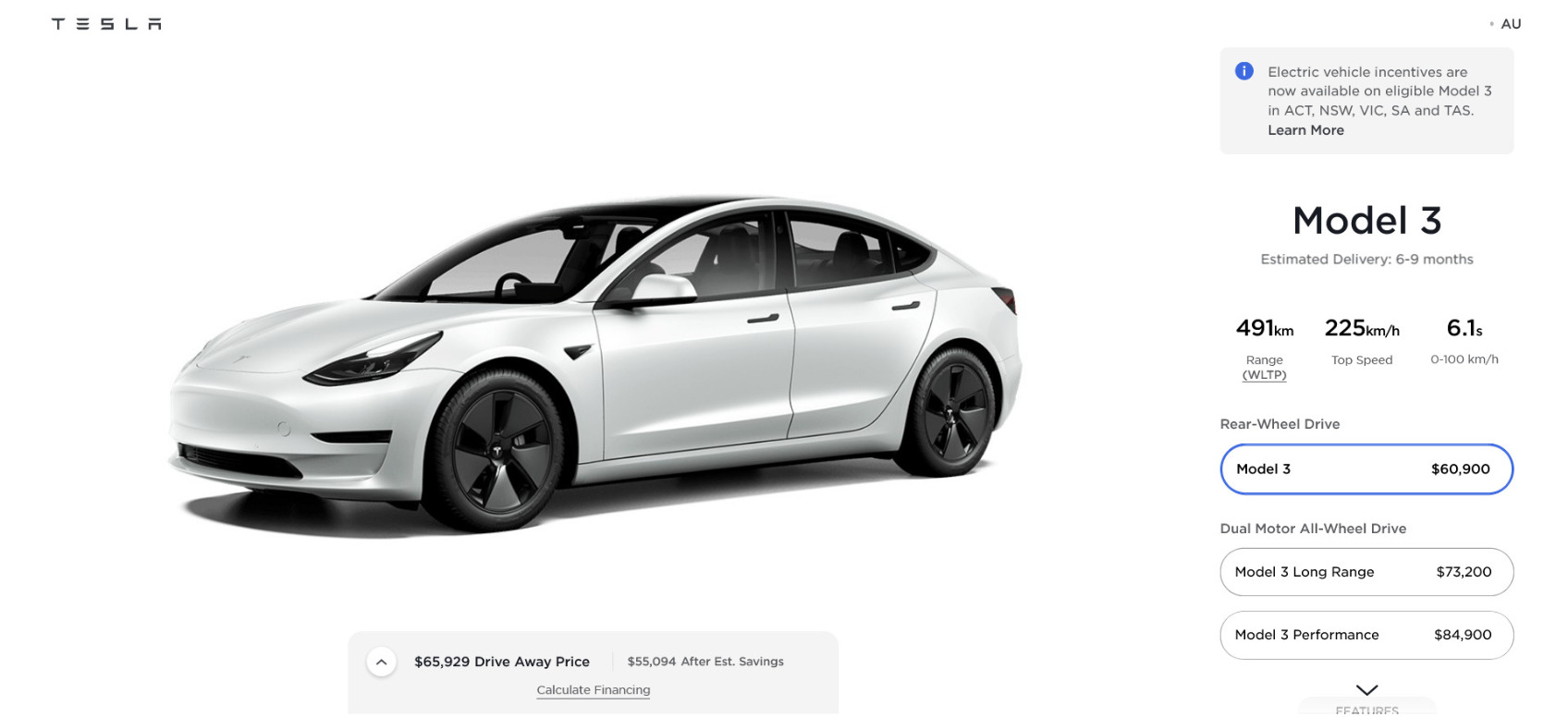

How Much Is A Tesla Here S A Price Breakdown

A tax credit of up to 7500 could be used.

. Buy and install new solar panels in New Jersey in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. Prudential Newark NJ NYSE. The residential ITC drops to 22 in 2023 and ends in 2024.

Making it the next most efficient luxury EV behind the Tesla Model 3. In times of expensive fuel you cant find an EV. Please consult your financial tax or other advisors to learn more about how state-based benefits and limitations would apply to your specific circumstance.

As of 2022 Tesla models are no longer eligible for the federal EV tax credit. The reason is that once a car manufacturer sells its 200000th vehicle the credit is reduced being cut in half to 3750 is then halved again after a period and then finally phased out. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners.

That said your Tesla purchase may be eligible for other state or local incentives depending on where you live. You may also contact your home states 529 plans or any other 529 plan to learn more. Electric Vehicles Solar and Energy Storage.

Its more than just the batteries being made here. Reduced Vehicle License Tax and carpool lane access. For the best experience we recommend upgrading or changing your web browser.

I forgot to mention that NJ where I live waives sales tax. For example my credit union defines new cars as anything with less than 7500 miles and no more than one calendar year old. Also know that the 7500 federal tax credit for Teslas.

OLDWICK NJ August 12 2022--AM Best has assigned a Long-Term Issue Credit Rating of bbb Good to the forthcoming 12 billion 6 junior subordinated notes due Sept. The tax credit should juice pun intended EVs as well. The minerals must also come from the continent.

Find expert reviews and ratings explore latest car news get an Instant Cash Offer and 5-Year Cost to Own information on. 14500 Approximate system cost in New Jersey after the 26 ITC in 2021. Model 3 Order Online.

You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV. Any EV with a 16 kWh battery or higher qualifies for the full 7500 credit. If you have a credit card you can reserve a Tesla now.

Only certain vehicles will now qualify for the 7500 credit Tesla and Chevy being big winners. 5 Average-sized 5-kilowatt kW system cost in New Jersey. Up to 1000 state tax credit Local and Utility Incentives.

Toyota recently met the 200000 cap in Q2 2022. From TFA Thats mainly because of the bills requirement that to qualify for the credit an electric vehicle must contain a battery built in North America with. Learn more and get 500 of f for a limited time.

Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Tesla might add a bit more range as well as a lower. The outlook assigned to these.

The entire point is to get TeslaLGetc to manufacture the batteries in the US. Vast majority of EV purchases wont qualify for a tax credit that large. 1 2052 and the 300 million 595 junior subordinated notes due Sept.

In the end I was able to get the sales tax back as Tesla wrote a notarized statement of fact for my DMV explaining due to a miscommunication I was provided an incorrect vehicle. Toyotas EV credit will begin phasing out in Q4 2022 with a 50 credit for Q4 2022 Q1 2023 then 25 for Q2 Q3 2023 then zero. It amuses me that whenever gas is cheap sales of big-ass SUVs go nuts.

Check car prices and values when buying and selling new or used vehicles. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. The Tesla Model Y has been on sale for a few years now.

Tesla is accelerating the worlds transition to sustainable energy with electric cars solar and integrated renewable energy solutions for homes and businesses. There is already an EV incentive in place and this bill would tweak the qualifications so much so that BMW and pretty much any other foreign manufacturers will not receive any tax credit instead of the 7500 they receive currently. You obviously dont realize the issue.

1 2062 to be issued by Prudential Financial Inc. Vast majority of EV purchases wont qualify for a tax credit that large. Tesla and GM met the 200000 EV cap and no longer receive the EV tax credit.

This is because Tesla reached the threshold of 200000 EVs sold back in July of 2018 triggering the phase-out period for the credit. Read Teslas 2021 Impact Report. Would restore tax credits for General Motors Tesla and Toyota all of.

Nearly A Third Of 2022 Us Ev Buyers Are Getting A Tesla Model Y R Electricvehicles

Biden S Electric Vehicle Ambitions May Send Tesla Stock Skyrocketing Beyond 1 300 Analyst

Ev Owners In N J Would Pay 150 More Annually If Governor Oks Higher Gas Tax Gas Tax All Electric Cars Owners

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Tesla Expands Availability Of New Texas Built Model Y And Raises The Price Electrek

2023 Tesla Model 3 What We Know So Far

Tesla Wait Times Stretch Out To 2023 But Is It Really Only Rich People Who Buy Them

:max_bytes(150000):strip_icc()/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

Tesla Cost Of Ownership Is It Worth It

Best Electric Luxury Cars In 2022 Carfax

Elon Musk Can Afford Biden S Ev Snub Reuters

Austrian Engineering Firm Installs A Range Extending Generator In Tesla Model 3 Frunk Tesla Model Tesla Tesla Model X

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

How Much Is A Tesla Lease In 2022 Electrek

2021 Tesla Model 3 Prices Reviews And Pictures Edmunds

10 000 Ev Tax Credit Coming Back In Depth Youtube

2021 Tesla Model 3 Prices Reviews And Pictures Edmunds

Why Are Tesla Electric Vehicles Not Eligible For The Tax Credit